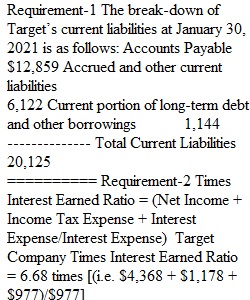

Q Description Financial Statement Case Assignments are a collection of individual assignments whose total point value equals 160. Please read the General Information and Instructions for the Financial Statement Case Assignments carefully before starting. Make sure you know how the fiscal year for Target Corporation is presented by watching the video. Financial Statement Case 11-1 Requirements 1. Give the breakdown of Target’s current liabilities at January 30, 2021. 2. Calculate Target’s times-interest-earned ratio for the year ending January 30, 2021. How does Target’s ratio compare to Kohl’s Corporation’s ratio? Rubric Financial Statement Case 11-1 Rubric Financial Statement Case 11-1 Rubric Criteria Ratings Pts This criterion is linked to a Learning OutcomeQuestion 1 4 pts Full Points Question answered accurately. 2 pts Half Points 1/2 of the question answered correctly 0 pts No Points Both parts of question answered incorrectly. 4 pts This criterion is linked to a Learning OutcomeQuestion 2 8 pts Question answered correctly 4 pts Half points Half of the question answered correctly 0 pts No points Answer is incorrect 8 pts Total Points: 12 PreviousNext

View Related Questions